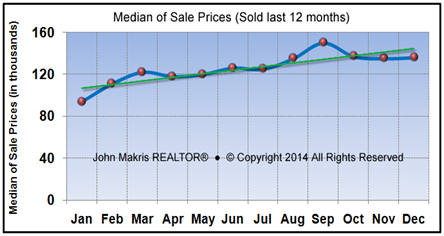

The Vero Beach real estate market for homes on the mainland gained strength in December 2014 with more sales and less inventory. The increase in sales this month bodes well for the start of the new 2015 season. Sales prices are still appreciating and increased by 4.4% compared to the same period in 2013. The increase in inventory may put some pressure in price appreciation.

This is an active market but we need to see more sales and further reduction of inventory to maintain price appreciation as we move forward into 2015.

Vero Beach Real Estate Market Highlights – December 2014

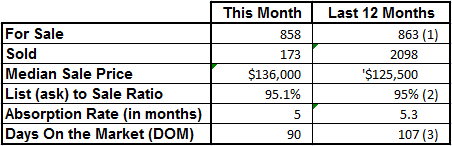

Sales increased by 28% compared to last month and 10% compared to the same period in 2013. However, inventory levels are still higher than 2013 and this fact has somewhat affected price appreciation. DATA SOURCE: MLS data as of 1/2/2015. Data believed to be accurate but not guaranteed.

DATA SOURCE: MLS data as of 1/2/2015. Data believed to be accurate but not guaranteed.

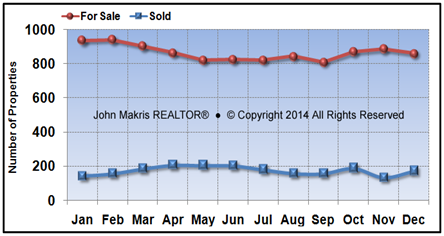

The chart above shows that the inventory of available homes for sale in Vero Beach mainland has been increasing the last few months but the market activity and the expected strong 2015 winter season may change this trend.

Vero Beach Real Estate Market Statistics – December 2014

DATA SOURCE: MLS data as of 1/2/2015. Data believed to be accurate but not guaranteed.

DATA SOURCE: MLS data as of 1/2/2015. Data believed to be accurate but not guaranteed.

Notes: (1) This is the average of all 12 months of inventory, (2) This is the average of all 12 months of List Price to Sale Price Ratio & (3) This is the average DOM in 12 month period.

The List (asking price) to Sale Price ratio is a useful statistic that shows the strength of a particular real estate market. The closer the sale price to list or asking price, the stronger the market is.

In Vero Beach mainland, we see that the list to sale price ratio (95.1%) was slightly increased, and the absorption rate, or months of inventory (5) indicates that we are in a seller’s market .

Vero Beach Real Estate Market Analysis – December 2014

This December, 173 homes were sold in Vero Beach mainland, 28% more than in November and 10% more than last year. The increase in sales bodes well for the sellers and the overall real estate market in Vero Beach mainland.The chart below shows that sale prices are slightly appreciating .

DATA SOURCE: MLS data as of 1/2/2015. Data believed to be accurate but not guaranteed.

DATA SOURCE: MLS data as of 1/2/2015. Data believed to be accurate but not guaranteed.

The median sold price for December was $172,000 with an average DOM of 90 days.

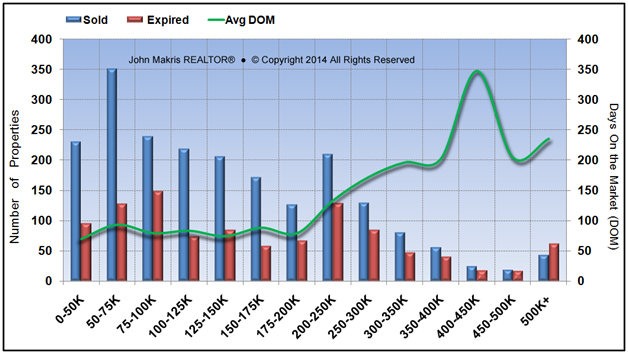

A Price Range analysis of homes sold versus homes that failed to sell (expired) and the days these homes were on the market (DOM) provides a useful statistic for the overall health of the Vero Beach mainland real estate market.

The chart below presents the number of homes Sold vs. Expired (failed to sell) the last 12 months and DOM of homes sold. Notice that homes up to $200,000 price ranges were sold the fastest with an average of 81 DOM.

DATA SOURCE: MLS data as of 1/2/2015. Data believed to be accurate but not guaranteed.

DATA SOURCE: MLS data as of 1/2/2015. Data believed to be accurate but not guaranteed.

More homes failed to sell (expired) above $500,000 price range, than sold in Vero Beach mainland. Homes from $400,000 to $450,000 price range took the longest to sell with an average of 347 DOM. Homes may expire for many reasons such as being priced too high, inadequately marketed, in poor condition, or owner decided not to sell.

The real estate market in Vero Beach mainland gained strength in December but high inventory levels and buyers focus on the barrier island may put some pressure on price appreciation. We will monitor the market next few month for any changes in the current trend and will alert our readers.

Detailed Real Estate Market Reports for Vero Beach mainland are produced on a monthly basis. If you would like to receive these real estate market reports, fill in the request form below with your email address and indicate that you wish to receive market reports in the message box. These reports will be sent to your email the beginning of the each month with market statistics of the previous month.

For sellers I provide detailed price analysis report specific to each area or zip code and a complimentary no-obligation price analysis consultation. Use the request form below and indicate that you wish to receive the detailed report and the no-obligation price analysis consultation.