If you are thinking of buying a home in Vero Beach this fall, this is the special edition of the Fall 2020 Buyers Guide, which explains Why Mortgage Rates Are Driving Affordability, How Technology Is Enabling the Real Estate Process, Steps to Take Now If You Want to Buy a Home, Things to Avoid After Applying for a Mortgage, and much more.

Take a look at what is inside in the Home Buyers Guide Summer of 2020 and get it for FREE today!

What is inside the Home Buyers Guide Fall 2020

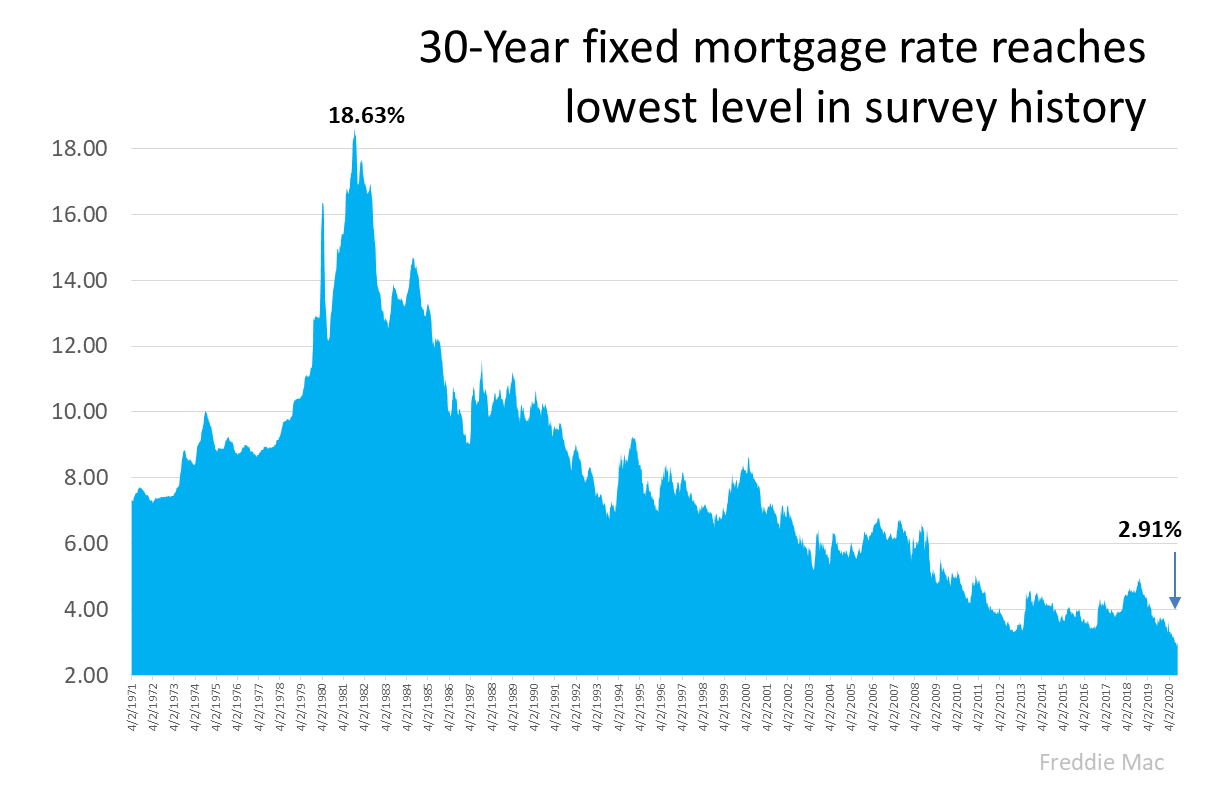

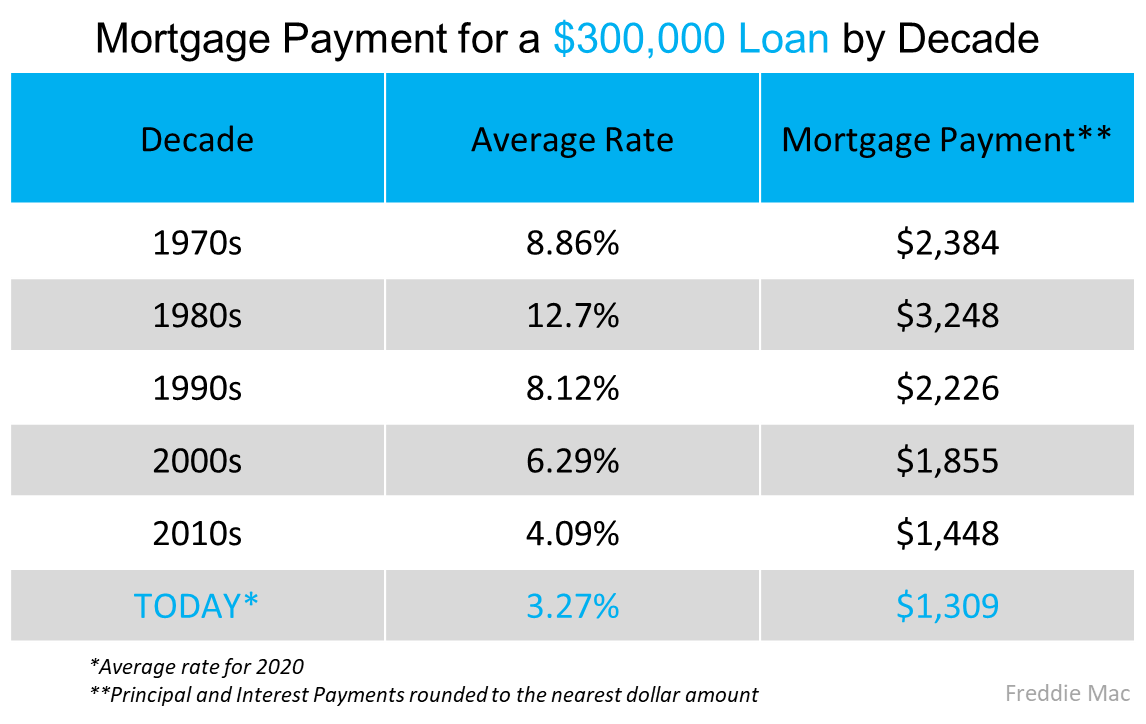

WHY MORTGAGE RATES ARE DRIVING AFFORDABILITY

What does this mean for buyers?

This is huge for homebuyers. Those currently taking advantage of the increasing affordability that comes with historically low interest rates are winning big.

As shown in the chart below, the average monthly mortgage payment decreases significantly when rates are as low as they are today.

A lower monthly payment means savings that can add up significantly over the life of your home loan. It also means you may be able to purchase more home for your money.

HOW TECHNOLOGY IS ENABLING THE REAL ESTATE PROCESS

Today’s reality is quite different than it looked at the beginning of the year. We’re getting used to doing a lot of things virtually, from how we work remotely to how we engage with our friends and neighbors. We’re learning how to function in new ways, especially as each local area moves in and out of various phases of business operation and the pandemic carries on. Following are some changes enabled by the new technology.

- Virtual Consultations

- Home Searches & Virtual Showings

- Document Signing

- Sending Money

- Closing Process

Two things working to a buyer’s advantage today are low mortgage rates and home prices. Here’s a look at what the experts are saying, and why sooner rather than later may be an ideal time to buy a home

Today’s low mortgage rates are not just low – they’re hovering near historic all-time lows. The even better news? According to Freddie Mac, rates are forecasted to remain low through the first quarter of next year (see graph).

STEPS TO TAKE NOW IF YOU WANT TO BUY A HOME

If you’re thinking about buying a home in Vero Beach this year, there are important things you can do right now to keep the home buying process moving forward. From pre-approval for a mortgage to saving for your down payment, you can still work confidently toward homeownership.

- Learn About the Process and How Much You Can Afford.

- Save For Your Down Payment & Closing Costs.

THINGS TO AVOID AFTER APPLYING FOR A MORTGAGE

Once you’ve found the right home and applied for a mortgage, there are some key things to keep in mind before you close on your home. You’re undoubtedly excited about the opportunity to decorate your new place, but before you make any large purchases, move your money around, or make any major life changes, consult your lender – someone who will be able to tell you how your financial decisions will impact your home loan.

Below is a list of things you shouldn’t do after applying for a mortgage. They’re all important to know – or simply just good reminders – for the process.

- Don’t Deposit Cash into Your Bank Accounts

- Don’t Make Any Large Purchases Like a New Car or Furniture for Your New Home

- Don’t Co-Sign Other Loans for Anyone

- Don’t Change Bank Accounts

- Don’t Apply for New Credit

- Don’t Close Any Credit Accounts

Whether buying your first home or your fifth, let’s talk about your needs and what you’re looking for to make sure the process goes smoothly

Get this Fall 2020 Buyers Guide and find out the financial reasons why owning a Vero Beach home of your own makes a lot of sense.

You will find a lot more information in this NEW seasonal edition of the Home Buyers Guide for Fall 2020 by requesting one using the form below. It is FREE.

Home Buyers Guide Request Form:

"*" indicates required fields

[…] The Fall 2020 Buyers Guide explains Why Mortgage Rates Are Driving Affordability, How Technology Is Enabling the Real Estate Process, Steps to Take Now If You Want to Buy a Home, Things to Avoid After Applying for a Mortgage, and much more. […]