The real estate market in Vero Beach mainland in June 2014 regained some strength with more sales and higher prices than in May and the same time last year. The market was active for homes priced below $250,000.

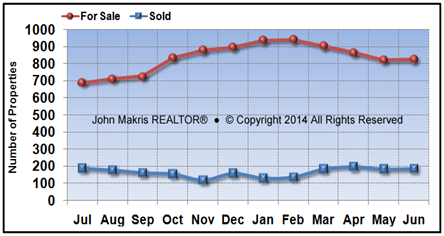

Although we have seen a slight reduction in the inventory, the gap between available homes for sale and actual sales remains high which has put pressure in price appreciation.

Vero Beach Real Estate Market Highlights – June 2014

Median of home values was higher by 17% from a year ago in Vero Beach mainland. The inventory has started decreasing which will help sale prices. Sales increased by 8.2% compared to the same period in 2013. DATA SOURCE: MLS data as of 7/2/2014. Data believed to be accurate but not guaranteed.

DATA SOURCE: MLS data as of 7/2/2014. Data believed to be accurate but not guaranteed.

The chart above shows that the inventory of available homes for sale in Vero Beach mainland has been decreasing the last 3 months. Total home sales for June 2014 were slightly higher than in May and 8% higher than last year.

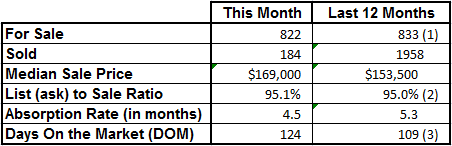

Vero Beach Real Estate Market Statistics – June 2014

DATA SOURCE: MLS data as of 7/2/2014. Data believed to be accurate but not guaranteed.

DATA SOURCE: MLS data as of 7/2/2014. Data believed to be accurate but not guaranteed.

Notes: (1) This is the average of all 12 months of inventory, (2) This is the average of all 12 months of List Price to Sale Price Ratio & (3) This is the average DOM in 12 month period.

The List (asking price) to Sale Price ratio is a useful statistic that shows the strength of a particular real estate market. The closer the sale price to list or asking price, the stronger the market is.

In Vero Beach mainland, we see that the list to sale price ratio (95.1%) is steady, the absorption rate, or months of inventory (4.5) indicates that the we are back to a seller’s market in some areas and price points .

Vero Beach Real Estate Market Analysis – June 2014

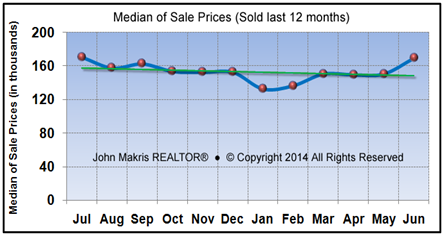

In June 182 homes were sold in Vero Beach mainland, 13% fewer than last year and 6.7% fewer than in May. The decrease in sales is a sign that demand is waning in post season. The median for the last 30 days was $150,000 with average days on the market (DOM) of 119 days.The chart below shows that sale prices are flat and slightly decreasing compared to a year ago (a 5% decrease). We’ll monitor the price action the next few months to determine whether this trend continues.

DATA SOURCE: MLS data as of 7/2/2014. Data believed to be accurate but not guaranteed.

DATA SOURCE: MLS data as of 7/2/2014. Data believed to be accurate but not guaranteed.

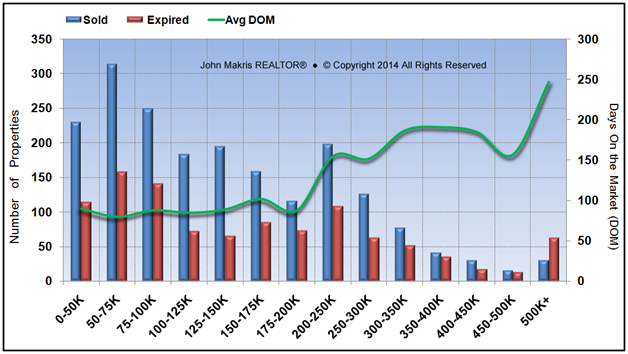

A Price Range analysis of homes sold versus homes that failed to sell (expired) and the days these homes were on the market (DOM) provides a useful statistic for the overall health of the Vero Beach mainland real estate market.

The chart below presents the number of homes Sold vs. Expired (failed to sell) the last 12 months and DOM of homes sold. Notice that homes in $50,000 to $75,000 price range were sold the fastest with an average of 80 DOM.

DATA SOURCE: MLS data as of 7/2/2014. Data believed to be accurate but not guaranteed.

DATA SOURCE: MLS data as of 7/2/2014. Data believed to be accurate but not guaranteed.

More homes failed to sell (expired) above $500,000 price range, than sold in Vero Beach mainland. Homes above $500,000 price range took the longest to sell with an average of 247 DOM. Homes may expire for many reasons such as being priced too high, inadequately marketed, in poor condition, or owner decided not to sell.

The market in Vero Beach mainland is still active but sale prices are flat..

The increase in inventory, the lack of investor appetite and the strong action on the barrier island may have affect sales. We will monitor the market activity during the summer doldrums for clues on market’s strength and will notify our clients.

Detailed Real Estate Market Reports for Vero Beach mainland are produced on a monthly basis. If you would like to receive these real estate market reports, fill in the request form below with your email address and indicate that you wish to receive market reports in the message box. These reports will be sent to your email the beginning of the each month with market statistics of the previous month.

For sellers I provide detailed price analysis report specific to each area or zip code and a complimentary no-obligation price analysis consultation. Use the request form below and indicate that you wish to receive the detailed report and the no-obligation price analysis consultation.