The market activity for condos on the barrier island increased in September as we saw a 57% increase in sales compared to August and slightly increased compared to the same period in 2013. Demand has remained steady for lower priced condos and has increased for condos priced from $500,000 to $700,000.

The increase in market activity in September may indicate a continued interest in second or vacation homes as mortgage rates remain low and the economy has improved.

The following sections provide a detail view of the Vero Beach real estate market for condos on the Barrier Island (zip code 32963).

Vero Beach Real Estate Market Highlights – September 2014

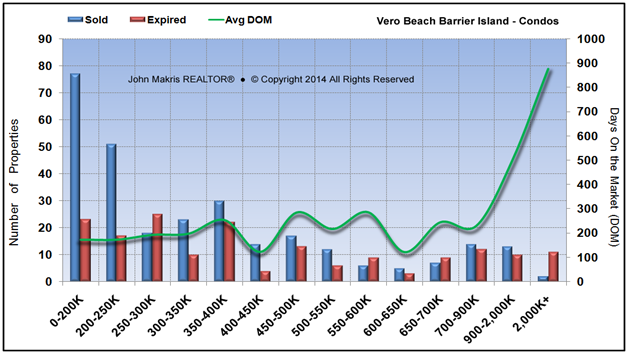

The seller’s market continues below $300,000 in the $350,000 to $400,000, $500,000 to $550,000, $600,000 to $650,000 and $700,000 to $900,000 price ranges . Inventory is getting reduced while sales remain fairly constant, a trend that has resulted in further price appreciation. DATA SOURCE: MLS data as of 10/2/2014. Data believed to be accurate but not guaranteed.

DATA SOURCE: MLS data as of 10/2/2014. Data believed to be accurate but not guaranteed.

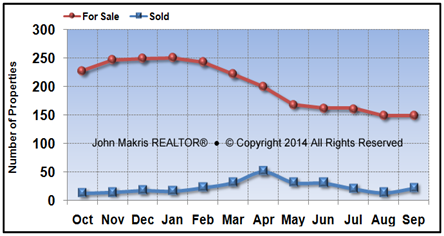

The chart above shows that the inventory has been decreasing the last 7 months, but it is still at higher levels compared to sales.

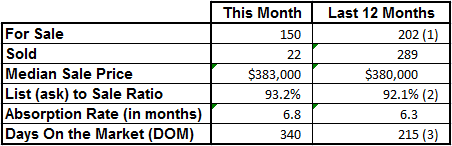

Vero Beach Real Estate Market Statistics – September 2014

DATA SOURCE: MLS data as of 10/2/2014. Data believed to be accurate but not guaranteed.

DATA SOURCE: MLS data as of 10/2/2014. Data believed to be accurate but not guaranteed.

Notes: (1) This is the average of all 12 months of inventory, (2) This is the average of all 12 months of List Price to Sale Price Ratio & (3) This is the average DOM in 12 month period.

The List (asking price) to Sale Price ratio is a useful statistic that shows the strength of a particular real estate market. The closer the sale price to list or asking price, the stronger the market is.

The Absorption Rate or moths of remaining inventory is 6.8 indicates renewed market activity in September for condos on the barrier island. The list to sale ratio of 93.2% is increasing, indicating that condos are selling close to the asking price. The demand for condos on the barrier island remained steady but waned a bit in during the summer months.

Vero Beach Real Estate Market Analysis – September 2014

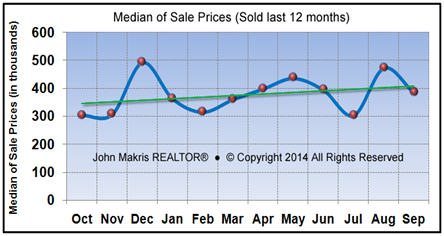

In September, 22 condos were sold on the island in Vero Beach, a 57% increase from August and slightly more than the same period in 2013. The sale prices have stabilized and slightly appreciating and increased by an average of 10% compared to the same period last year, although were lower than in August(see the chart below). DATA SOURCE: MLS data as of 10/2/2014. Data believed to be accurate but not guaranteed.

DATA SOURCE: MLS data as of 10/2/2014. Data believed to be accurate but not guaranteed.

A Price Range analysis of condos sold versus condos that failed to sell (expired) and the days these properties were on the market (DOM) provides a useful statistic for the overall health of the real estate market for condominiums on the barrier island (zip code 32963) in Vero Beach.

The chart below presents the number of condos Sold vs. Expired (failed to sell) the last 12 months and the Days On The Market (DOM) of condos sold.

DATA SOURCE: MLS data as of 10/2/2014. Data believed to be accurate but not guaranteed.

DATA SOURCE: MLS data as of 10/2/2014. Data believed to be accurate but not guaranteed.

More condos failed to sell (expired) than sold in $250,000 to $300,000, $550,000 to $600,000 and above $2M price ranges. Condos above $900,000 took the longest to sell with an average of 687 DOM.

The market for condos on the barrier island in Vero Beach remains active with sale increases and improvement in some areas and low months of remaining inventory (absorption rate). Subscribe to the detailed market report below to see where the market for condos on the island is stronger.

Detailed Real Estate Market Reports for Condos on the Vero Beach barrier island (zip code 32963) are produced on a monthly basis. If you would like to receive these real estate market reports, fill in the request form below with your email address. These reports will be sent to your email the beginning of the each month with market statistics of the previous month.

For sellers I provide detailed price analysis report specific to each area and a complimentary no-obligation price analysis consultation. Use the request form below and indicate that you wish to receive the detailed report and the no-obligation price analysis consultation.