Every four years, as the country turns its focus to the presidential election, questions arise about how the results may affect various sectors, especially the housing market. If you’re asking how the upcoming election is likely to impact real estate, you’re not alone. Analyzing historical trends can shed light on what to expect in terms of mortgage rates, home prices, and sales volume.

The Pre-Election Period: An Uptick in Affordability?

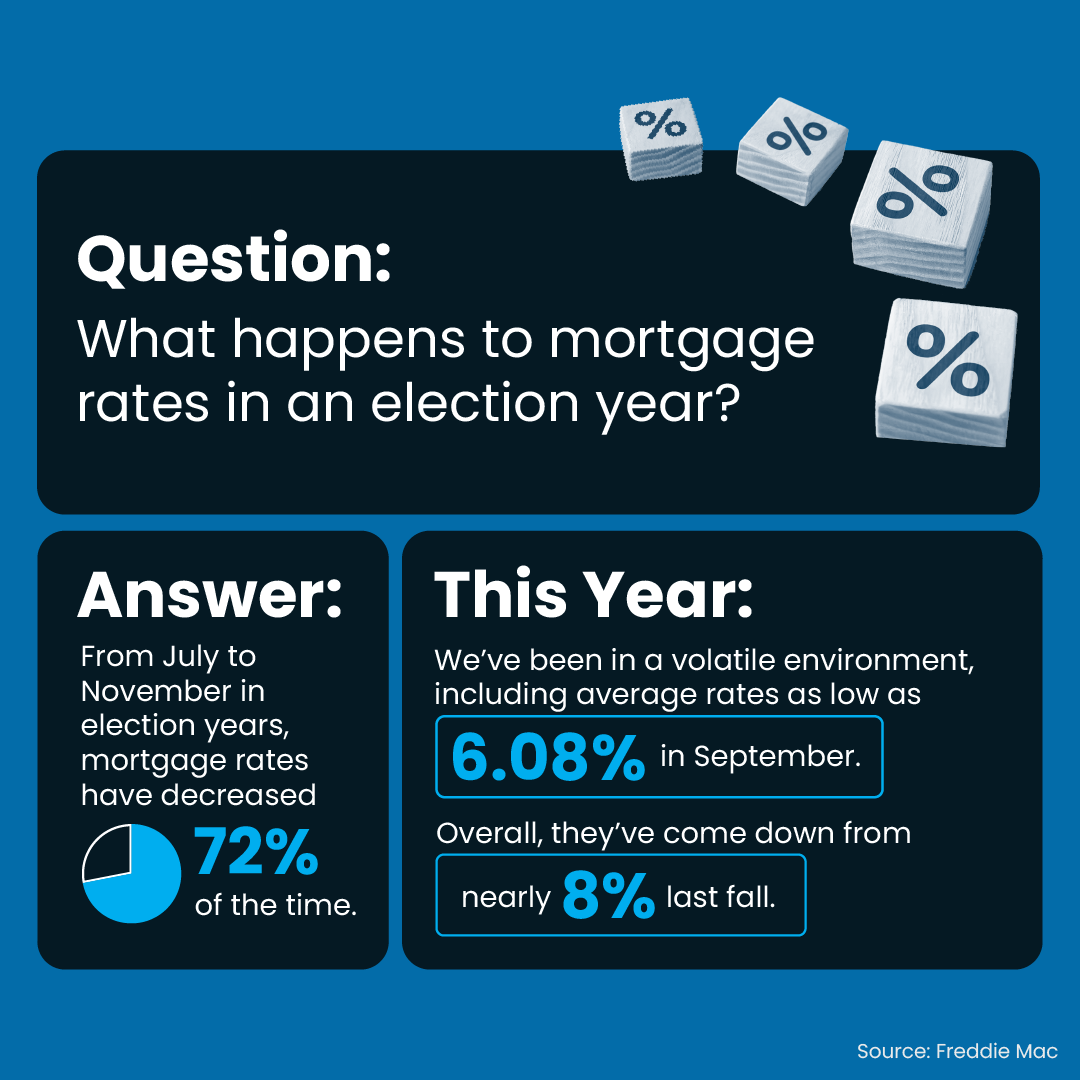

One trend that tends to recur is a dip in mortgage rates leading up to an election. As uncertainty looms, the Federal Reserve and mortgage lenders often work to stabilize markets, which may result in lower interest rates. This drop is meant to offset any unease in the economy, making homebuying a bit more affordable and providing reassurance to potential buyers. Lower rates can be an excellent opportunity for homebuyers to lock in favorable mortgage terms before rates fluctuate again post-election.

Post-Election Market Trends: Home Prices on the Rise

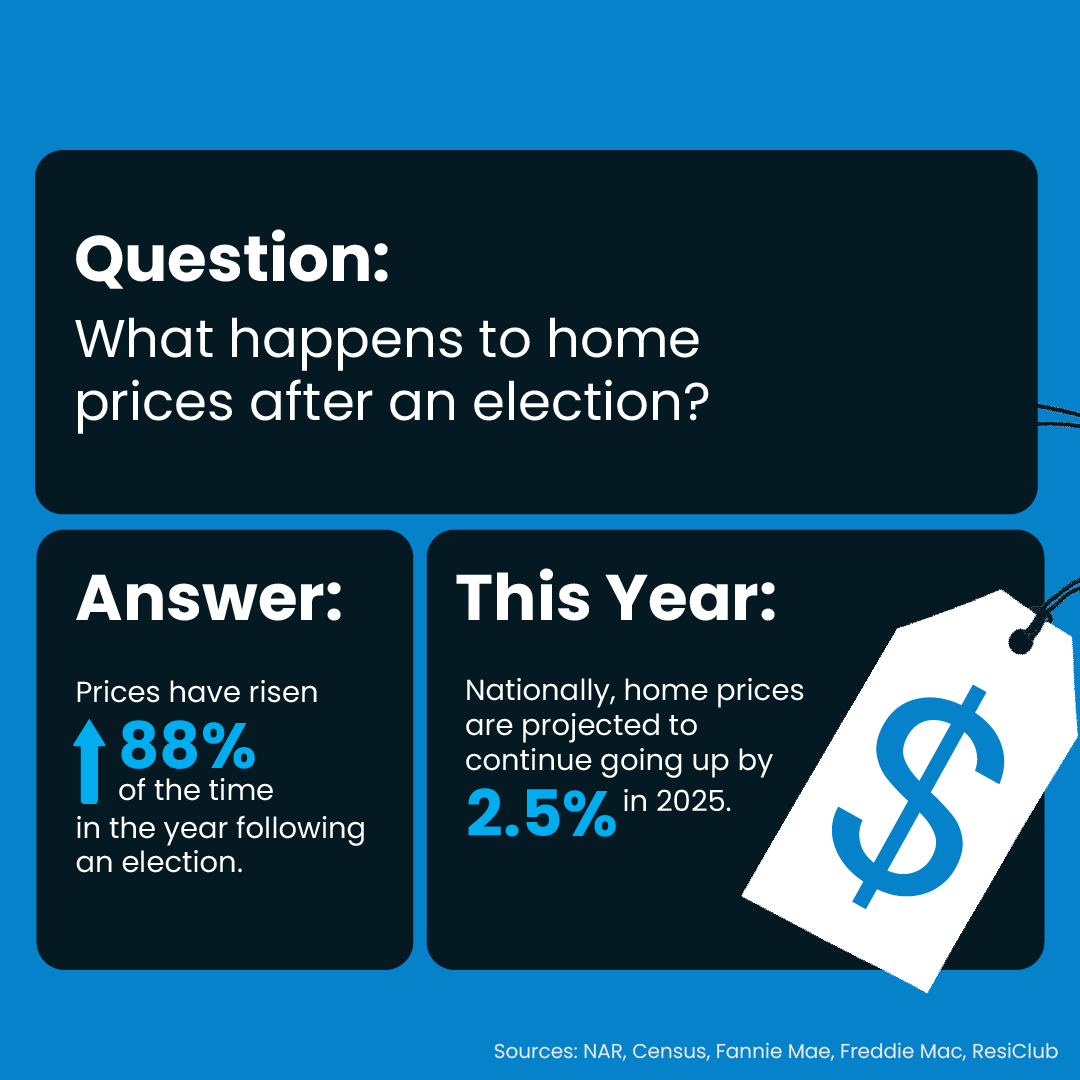

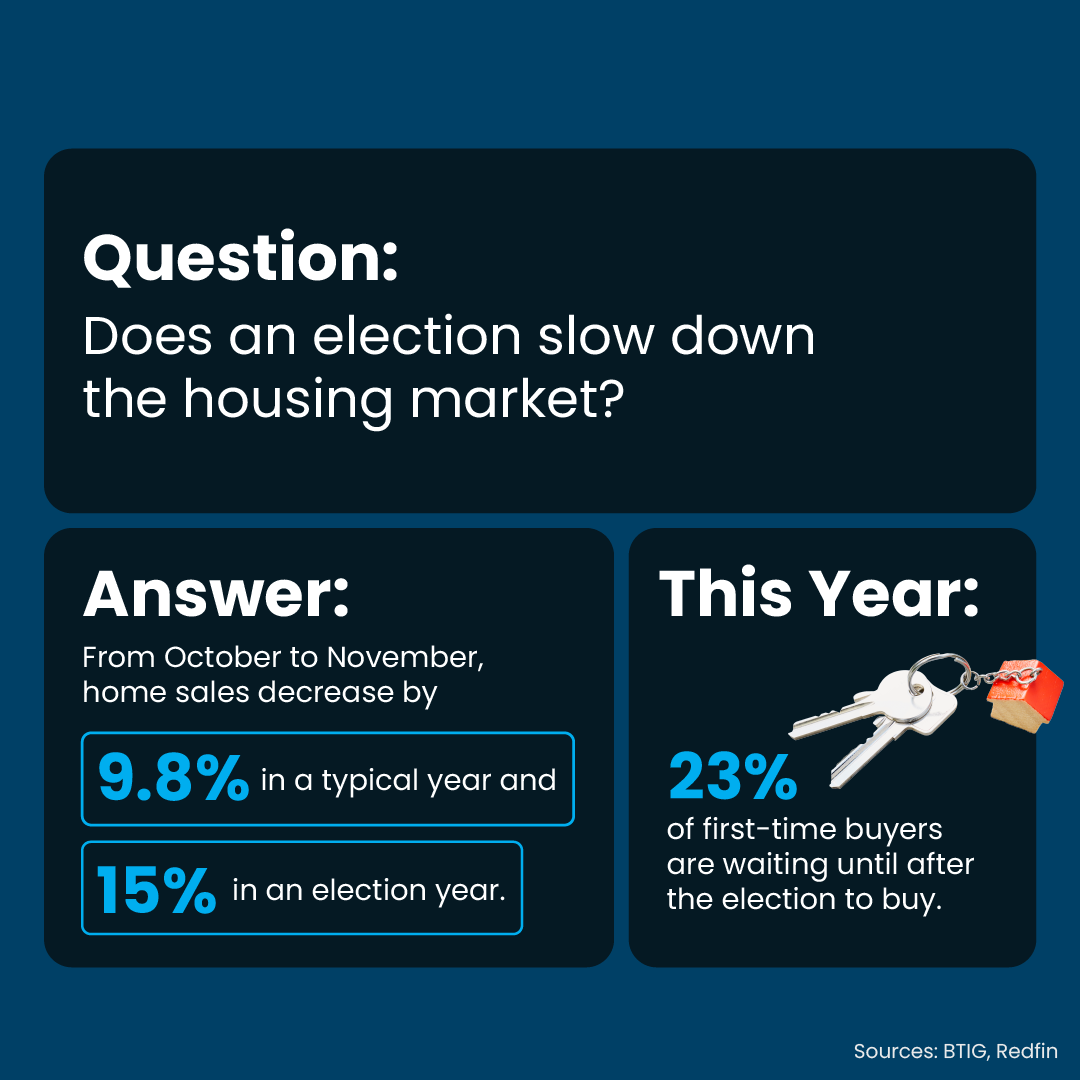

Once the election is over, a new phase usually begins, characterized by increased activity in home sales and often a rise in home prices. Regardless of the election outcome, historical data suggests that home prices and sales generally increase in the year following an election. With a renewed sense of direction and economic confidence, consumers tend to feel more comfortable making long-term investments, which drives up demand in the housing market. However, this uptick can vary depending on the broader economic policies enacted by the incoming administration.

The Broader Picture: Economic and Policy Influences

While elections have a marked impact, broader economic factors often dictate the scale of change. Policies related to taxes, interest rates, and government spending all shape the housing landscape. For instance, changes in tax policies regarding homeownership deductions or incentives for first-time buyers can significantly impact market dynamics. Additionally, any adjustments to financial regulations, especially those affecting mortgage lending, may influence buyers’ and investors’ confidence.

Should You Buy or Sell During an Election Year?

With mortgage rates potentially lower and home prices poised to rise after the election, both buyers and sellers might find reasons to act. Buyers may benefit from lower rates before the election, while sellers could capitalize on rising demand afterward. That said, market timing shouldn’t be the only consideration. Personal financial readiness and long-term housing goals are key factors in making the right decision.

If you’re navigating the market during this election cycle, let’s chat. I can offer insights and guide you through the steps to make the most of the timing and opportunities available in your area. Just complete the form below and I will contact you to discuss how this unique period may open doors for your real estate goals.

Vero Beach Real Estate Services Form:

"*" indicates required fields

Data Sources

- https://researchwiseny.btig.com/ResearchLibraryAnalec/DownloadResearch.aspx?E=cafidk-b

- https://www.redfin.com/news/homebuying-delay-election-survey-2024/

- https://www.huduser.gov/periodicals/ushmc/fall08/hist_data.pdf

- https://www.nar.realtor/research-and-statistics/housing-statistics/existing-home-sales

- https://www.fanniemae.com/media/53421/display

- https://img03.en25.com/Web/MortgageBankersAssociation/%7B497ab7d7-e310-4609-b693-054c670afa77%7D_Mortgage_Finance_Forecast_Sep_2024.pdf

- https://www.nar.realtor/sites/default/files/2024-10/forecast-q3-2024-us-economic-outlook-10-04-2024.pdf

- https://www.census.gov/construction/nrs/pdf/newressales.pdf

- https://www.nahb.org/-/media/NAHB/news-and-economics/docs/housing-economics/sales/nationwide-sales-and-inventory.pdf?rev=2a0e5741e9ea48c1b6e91a9b03677a5c&hash=D0A99213F8688CE67BB701E648D05ED8

- https://www.census.gov/construction/chars/

- https://www.goldmansachs.com/insights/articles/us-house-prices-are-forecast-to-rise-more-than-4-percent-next-year

- https://www.fanniemae.com/research-and-insights/surveys-indices/home-price-expectations-survey-hpes

- https://www.morganstanley.com/articles/mortgage-rates-forecast-2024-2025-will-mortgage-rates-go-down

- https://www.resiclubanalytics.com/p/goldman-sachs-vs-moodys-expect-national-home-prices-go-2027

- https://www.resiclubanalytics.com/p/early-predictions-national-home-prices-2025-according-8-major-research-groups

- https://x.com/NewsLambert/status/1803568680803901553

- https://www.freddiemac.com/pmms/archive